Why Buying a Home Still Pays Off in the Long Run

Renting can feel much less expensive and much simpler than buying a home, especially right now. No repairs, no property taxes, no worrying about mortgage rates – you just pay the bill and move on with your life.

But here’s the part people don’t talk about enough: renting doesn’t help you build your financial future. Meanwhile, homeowners grow their net worth just by owning a home.

So, if you’ve been wondering whether buying is still worth it, the long-term math is clearer than you might think.

Renting vs. Owning: How the Costs Really Compare

Let’s break down one of the key differences between renting and buying. When you rent, your payment goes to your landlord, and then it’s gone. When you own, part of your payment comes back to you in the form of equity (the wealth you build as the value of your home increases, and you pay down your home loan).

So, while renting may seem more affordable now, you have to remember it comes at a long-term cost: you’re not building your wealth. And it turns out, that’s a bigger miss than you may expect.

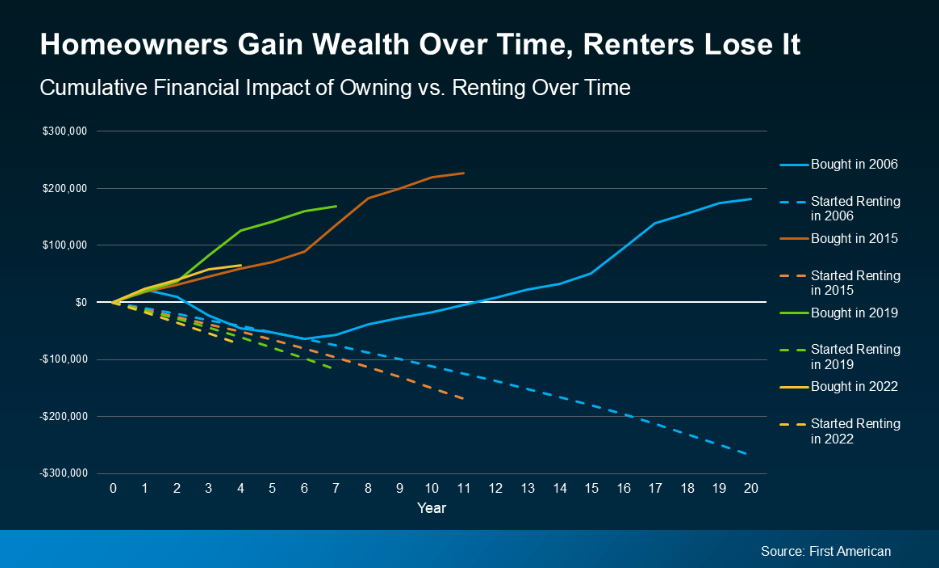

First American recently analyzed the long-term financial impact of renting versus owning a home. They compared mortgage payments, property tax, insurance, repairs, and maintenance against the equity gained through home price appreciation and paying down the mortgage. And they did that during several different time frames to see if it tells a consistent story:

2006: the start of the housing bubble

2015: 10 years ago

2019: just before the pandemic (the last normal years in the market)

2022: when mortgage rates jumped

In each time frame, two things were true: renters ended up losing money over time. And homeowners gained it.

Here’s some data so you can see this play out. Each color represents one of the key time frames. The solid lines show the buyer’s investment over time and how their net worth actually grew the longer they lived in their home. The dashed line represents the renter’s investment. In the end, they sank more and more cash into renting without gaining any financial benefit.

The takeaway is simple: time in a home builds wealth. Time renting doesn’t.

Basically, homeowners come out ahead. And the analysis shows that’s even after you factor in the other expenses that come with homeownership, like insurance, repairs, and property taxes. And that's the case for every time frame First American looked into.

On the flip side, renters spent money on their rent, but didn’t gain any long-term financial benefit. That’s true no matter what window of time you look at in the study.

Now, that doesn’t mean buying always beats renting in the short term. But the longer you own, the wider the wealth gap becomes.

Investing in the American Riviera: The Santa Barbara Difference

While the national trend favors buying for long-term wealth, this benefit is amplified dramatically in a high-demand, supply-constrained market like Santa Barbara.

Enduring Scarcity Protects Your Investment: Santa Barbara's unique geography—nestled between the ocean and mountains with strict zoning—creates an extreme limited supply. This scarcity helps property values remain resilient and often increase, even when national markets fluctuate. Historically, our real estate has proven to be a reliable store of wealth due to the enduring appeal of the "American Riviera" lifestyle.

Soaring Rents Make Equity Critical: Rents in Santa Barbara County are already far above the national average and continue to rise significantly. This means that every month you rent, the financial opportunity you are losing by not building equity grows larger. Owning allows you to lock in a principal and interest payment and leverage the local market's appreciation to build wealth and offset your high cost of living.

A Stable Market for Long-Term Confidence: Unlike highly volatile markets, Santa Barbara's value is sustained by strong local demand and a significant base of buyers who prioritize our unparalleled quality of life. This helps support steady, meaningful appreciation over time, providing confidence in your long-term investment.

Affordability Is Starting To Improve

You might still be thinking, “Okay, but buying feels out of reach for me right now.” Fair.

The past few years haven’t been easy for buyers. But things are starting to shift. Mortgage rates have come down this year, home prices are softening, and incomes have been rising. And according to Zillow, typical monthly payments have gotten a little easier compared to this time last year. Not by a lot, but enough to make a difference.

No, buying isn’t suddenly easy. But it is easier than it was just a few months ago. And in the long run, history shows it’s worth it.

Bottom Line

Renting may feel less expensive today, but owning is what builds real wealth over time. In a unique, high-value location like Santa Barbara, the fundamental scarcity and enduring demand dramatically amplify the financial benefits of homeownership. And with affordability starting to improve, the path to homeownership may be opening up more than you think.

If you’re curious what buying could look like for you, let’s connect. We can figure out your next move, pressure-free. Call or email today to schedule a Complimentary Buyers Consultation.

*The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Brisaly Balderas and Keeping Current Matters, Inc. do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Brisaly Balderas and Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.